About Stonehan Accountancy

At Stonehan Accountancy, P.C. (Stonehan), we bring unmatched expertise in financial and business management tailored specifically for the real estate sector. We transcend the role of traditional CPAs, offering a sophisticated, CFO-level approach to your financial needs. In today's complex and rapidly evolving market, we offer sophisticated investors the financial guidance and assurance needed to meticulously manage their real estate investments.

WHY CHOOSE STONEHAN?

Unparalleled Depth of Analysis:

Our commitment to rigorous scrutiny and contrarian thinking ensures we delve deeper than most to vet investment opportunities and partners. This meticulous approach allows us to confidently identify lucrative ventures that meet your high standards.

CFO-Led Expertise:

With a leadership background that includes managing a $1B Real Estate Lending Fund registered with the SEC and serving over 1,400 investors, our CFO brings unparalleled financial acumen and strategic insight to your portfolio.

Comprehensive Asset Management:

We manage assets exceeding $25 million, showcasing our capability to handle substantial portfolios with precision and sophistication. Our experience ensures that every aspect of your investments is optimized for maximum return and minimal risk.

Innovative Real Estate Development:

As Co-GP/CFO of a Modular Real Estate Development project, we integrate financial expertise with hands-on development experience, providing a unique perspective that enhances your real estate investments.

Entrepreneurial Perspective:

Having started our own CPA practice, we infuse every client engagement with entrepreneurial energy and innovative thinking. This dynamic approach allows us to deliver exceptional service and proactive financial solutions.

Entrust Stonehan with your real estate financial needs and experience the benefits of working with a firm dedicated to optimal planning, implementation, management, and control of your real estate financial operations. Discover how Stonehan Accountancy, P.C. can transform the financial elements of your real estate business with precision and sophistication.

Our Core Values

Ruthless Skepticism

Meticulous Financial Planning

Comprehensive Vision

Contrarian Thinking

White-Glove Service

Ruthless Skepticism

Ruthless

Skepticism

Meticulous

Financial

Reporting

Comprehensive

Vision

Contrarian

Thinking

White-Glove

Service

Entrepreneurial

Execution

How Real Estate Developers Legally Pay Zero Taxes, Advanced K-1, K-2, K-3 Strategies

Featuring: Eugene Gershman (EG Real Estate Developer Podcast) & James Bohan, CPA, MRED

This conversation originally aired on the EG Real Estate Developer Podcast (Land to Legacy), hosted by Eugene Gershman, a show dedicated to breaking down the mechanics of development, finance, construction, and long-term wealth building.

In this episode, Eugene brings on CPA, fund CFO, and fourth-generation real estate developer James Bohan to explain why real estate developers pay almost zero taxes legally, and how changes in K-1/K-2/K-3 reporting transformed compliance forever.

James also dives into partnership tax, entity stacking, modular development, PACE financing, fund formation, and why most syndicators fail due to back-office mistakes. Whether you’re a developer, fund manager, or sophisticated LP, this episode is a masterclass in advanced real estate structures.

Summary:

This episode reveals how professional real estate operators legally pay minimal taxes, and why the U.S. tax code is designed to reward developers.

You’ll learn:

How depreciation, leverage, and qualified non-recourse debt shelter income

Why developers can pull out tax-free cash while growing equity

What K-2s and K-3s reveal about investor allocations and global compliance

Why tax reporting complexity just increased 10×

LP vs LLC vs S-Corp vs C-Corp (and why C-Corps almost never belong in real estate)

Entity stacking and management company design, the backbone of fund strategy

How cost segregation changes for developers vs buyers

Active vs passive income, what most CPAs mis-explain

Real Estate Professional Status (REPS) and grouping elections

Modular multifamily development: speed, cost, QC, financing, and risk

PACE financing and lender compatibility

What it really takes to raise a professional real estate fund

Why back office failures destroy more deals than bad investments

This interview is a must-watch for developers, fund managers, family offices, and high-level operators who want institutional-quality structure and elite tax planning.

Watch the Full Episode:

FAQ's

1. Why do developers legally pay almost zero taxes?

Because depreciation, leverage, and qualified non-recourse debt allow income to be sheltered and cash to be pulled out tax free.

2. What’s the difference between K-1s, K-2s, and K-3s?

K-2s and K-3s break out detailed components of income for international tax compliance, making reporting far more complex.

3. Why don’t developers use C-Corps?

C-Corps trigger double taxation and are structurally inefficient for real estate.

4. What makes modular multifamily attractive?

Speed. Faster delivery increases IRR, and assembly-line construction reduces risk and improves quality control.

📞 Book a Tax Strategy Call with James:

https://calendly.com/jamesbohan/book-a-call

📨 Connect With James:

LinkedIn: James Bohan, CPA, MRED

Instagram: @jamesbohancfo

Website: stonehan.com

Chapter Breakdown With Timestamps:

00:00 – Cold Open: Trump, Zero Taxes, and Why K-2s and K-3s Exist

01:31 – Introducing James Bohan: CPA, Developer, Investor

01:52 – Why the Tax Code Favors Real Estate Development

02:47 – Depreciation, Debt, and Pulling Out Cash Tax Free

03:35 – Why DIY Taxes Fail: Complexity, Software Limits, and International Investors

05:02 – 199A, K-1 vs K-2/K-3, and the Rise of Global Tax Reporting

07:06 – Cost Segregation, Structure Strategy, and Entity Design

09:40 – Active vs Passive: What the IRS Really Means

12:49 – James’ Portfolio: Motel Conversion, Storage, Multifamily, Modular Projects

14:48 – Modular Construction Explained: Volumetric vs Panelized

16:06 – Inspections, Codes, and How States Adapt to Modular

17:45 – Costing, GCs, Risk Mitigation, and Prototype Modules

21:25 – Where Modular Saves Time and Boosts IRR

22:56 – Financing Modular: Draws, Liens, and Getting the Right Lenders

23:39 – PACE Financing, Leverage Stacking, and Tax Assessment Mechanics

26:23 – Depreciation on New Construction vs Buying Existing Assets

27:31 – Raising Equity: Family Capital, Funds, and Institutional Partners

28:46 – What It Really Takes to Raise a Fund

29:56 – Why Back Office Failure Kills 50% of Funds

31:30 – Institutional Reporting: NAV, Fair Value, Debt Share, REO Schedules

32:11 – How to Work With James (Contact Info)

Original Episode:

This conversation originally aired on EG Real Estate Developer (Land to Legacy).

Watch here: https://www.youtube.com/watch?v=7qyNDI5cFHw

Full Transcript:

00:00 – Cold Open: Trump, Zero Taxes, and Why K-2s and K-3s Exist

James (00:00):

Everyone here says Donald Trump pays zero in taxes. That is because the tax code is set up for real estate developers to pay zero taxes. The government is getting so aggressive, they have started to ask for these things called K-2s and K-3s, where they start to break out different items of your return and how it is allocated to you.

James (00:18):

I wanted to see what it would take to do my own taxes. I realized how difficult and complicated it is for a small business to actually file taxes.

James (00:28):

When you are building something, you know what you are building. When you are buying something, you do not know what you are buying. Most of real estate lives in the partnership tax world.

James (00:37):

That is usually a combination of LPs, limited partnerships, and LLCs. We just bought a piece of land here in Idaho that had this seven-unit boutique motel on it, and we were looking to redevelop that into apartments because when we have a hammer, everything looks like a nail. So we are multifamily people.

James (00:56):

Led to Legacy. I am part of a modular development team where we are building 205 multifamily units in Denver, and modular construction is really cool. You are saving a lot of time.

Eugene (01:11):

What does it actually take to raise a fund?

James (01:13):

It takes knowing a lot of people with money at the end of the day.

01:31 – Introducing James Bohan: CPA, Developer, Investor

Eugene (01:17):

Welcome to another episode of Real Estate Development Land to Legacy.

Eugene (01:22):

James Bohan. You are a CPA, you are a real estate investor, you are a developer. You do all these things. Sounds amazing. Thank you for being here.

James (01:31):

Absolutely. Thanks for having me on, Eugene.

01:52 – Why the Tax Code Favors Real Estate Development

Eugene (01:44):

So tell me, how does being a CPA and being a real estate investor and developer work together?

James (01:52):

They actually go hand in hand in such a great way. The real estate industry is one of the best ways to minimize your tax burden legally in this environment. Everyone hears Donald Trump pays zero in taxes. That is because the tax code is set up for real estate developers to pay zero taxes.

James (02:18):

The real estate lobby in America is one of the biggest lobbies, and when you look at it from an economics perspective, when people buy homes, they are hitting almost every sector of the economy. They are paying contractors, buying consumer goods, filling their kitchen with Amazon purchases. Real estate transactions are one of the biggest drivers of economic activity. That is why the tax code incentivizes development so heavily.

02:47 – Depreciation, Debt, and Pulling Out Cash Tax Free

Eugene (02:43):

What is an example of paying less tax?

James (02:47):

The biggest one is depreciation. But what people do not know are the nuances regarding debt. If you have an asset that appreciates a hundred percent in value, the only way to capture that in most industries is to sell and then pay capital gains tax.

James (03:03):

With real estate, you can use non-recourse debt for your investors or recourse debt for yourself to get more basis in the asset. Once you have more basis because of debt, you can pull cash out tax free. Qualified non-recourse debt has been protecting real estate investors for decades.

03:35 – Why DIY Taxes Fail: Complexity, Software Limits, and International Investors

Eugene (03:35):

I just have to share a story. Since our tax deadline for LLC extensions just passed, I conducted an experiment. I wanted to see what it would take to do my own taxes.

Eugene (03:54):

I realized how difficult and complicated it is for a small business to actually file taxes. At one point, I got so angry because not only do you need to understand tax code, you also have to fight the tools. The software I bought was not adequate.

Eugene (04:19):

I spent hours on it. That was my pitch recently to my friends: if you want to invest in real estate, invest passively. If you try to DIY everything, including the taxes, it gets complicated fast.

Eugene (04:48):

I used to be angry at CPAs charging me $5,000. Now I know why.

James (05:02):

Yes. Everything always looks simple until you start asking more questions. Maybe one investor is in China, so now you are dealing with international tax issues. The software sucks all over the place. I pay $10,000 a year for big-four-level software and even that is frustrating.

05:02 – 199A, K-1 vs K-2/K-3, and the Rise of Global Tax Reporting

James (05:31):

The tax laws are always changing. With the Trump Tax Act, 199A came out with a new 20 percent pass-through deduction. That added more reporting.

James (05:52):

Then came K-2s and K-3s. A K-1 shows your net rental loss after depreciation, but K-3s break everything out separately: gross income, depreciation, interest expense.

James (06:53):

These items get taxed differently by international regimes. When you have international investors, reporting becomes a nightmare. It is nearly impossible for even smart people to DIY now.

07:06 – Cost Segregation, Structure Strategy, and Entity Design

Eugene (07:06):

I grew up in construction. When we think about a building, we think materials, structure, how to build it. Do you analyze structure first when advising clients?

James (07:36):

When you talk materials, the first thing I think of is a cost segregation study. You look at every component you are putting into the building and determine its tax classification.

James (07:46):

I also look at how the management company relates to the fund, and how the development company fits in. C corps, S corps, partnerships – these are all tools. My job is to design the structure that yields the best after-tax outcome.

09:40 – Active vs Passive: What the IRS Really Means

Eugene (09:40):

You mentioned passive versus active. What is the difference?

James (09:48):

Active income is where you materially participate. The IRS metric is 500 hours. Ordinary income can be active or passive. Investment income like dividends and bonds is not passive in tax terms. That is investment income.

James (10:45):

Do not confuse investment income with passive ordinary income.

James (11:11):

Passive K-1 income is income from a business you do not materially participate in. You can only offset passive income with passive losses.

James (12:05):

Real estate professionals can make all of their real estate activity active. They can also group investments so that deals they invest passively in become active for them.

12:49 – James’ Portfolio: Motel Conversion, Storage, Multifamily, Modular Projects

Eugene (12:45):

What kind of properties do you invest in?

James (12:49):

Traditionally multifamily. We also have storage and mixed-use assets. We bought a seven-unit motel in Idaho intending to redevelop it into apartments.

James (13:10):

But for many macro and micro reasons, it did not make sense to blow it up. Instead, we repositioned it, added three more rooms, got an events permit, and now operate it efficiently with AI and tech.

James (13:58):

I am also part of a modular development team building 205 units in Denver.

14:48 – Modular Construction Explained: Volumetric vs Panelized

Eugene (14:48):

What style of modular do you prefer?

James (15:15):

Volumetric, factory-built units stacked like Legos. Panelization is more like building walls piece by piece. Volumetric is simpler and more scalable.

16:06 – Inspections, Codes, and How States Adapt to Modular

Eugene (16:06):

States vary in their rules. How does permitting work?

James (16:26):

Our site is in Denver, but modules are built in Boise. Colorado inspectors fly to the Idaho factory to ensure everything meets code. States are adapting.

17:45 – Costing, GCs, Risk Mitigation, and Prototype Modules

Eugene (17:45):

How do you estimate cost?

James (18:46):

Back-of-the-envelope numbers first. If the deal pencils, we then get competitive bids.

James (19:45):

Modular requires GCs with modular experience. Factories also build prototype modules and fly the GC and subs out to inspect before production.

21:25 – Where Modular Saves Time and Boosts IRR

Eugene (21:09):

Does modular really save time?

James (21:25):

Yes. Factories build multiple floors at once. Also, draws come later, closer to stabilization, boosting IRR.

22:56 – Financing Modular: Draws, Liens, and Getting the Right Lenders

Eugene (22:23):

Financing seems tricky. How do you solve the lien and draw issues?

James (22:56):

Work with lenders familiar with modular. Traditional banks often cannot handle this.

23:39 – PACE Financing, Leverage Stacking, and Tax Assessment Mechanics

Eugene (23:39):

What is PACE financing?

James (23:48):

PACE is a nationwide program that finances clean-energy-qualified developments. It sits as a tax assessment, technically senior to the lender.

James (24:17):

But only the annual payment is senior, similar to property taxes.

26:23 – Depreciation on New Construction vs Buying Existing Assets

Eugene (26:23):

How does depreciation work for new construction?

James (26:55):

Nearly the same. You already know the categorized costs as the developer, so you may not need a third-party cost segregation study.

27:31 – Raising Equity: Family Capital, Funds, and Institutional Partners

Eugene (27:31):

Where does your equity come from?

James (27:49):

Family capital for Idaho. Institutional capital for Denver. We are preparing to raise a fund for future acquisitions.

28:46 – What It Really Takes to Raise a Fund

Eugene (28:41):

People say raising a fund is easy. What does it take?

James (28:46):

You need a securities attorney, a prospectus, relationships, and experience. I create the framework, tie up properties, then raise around those deals.

29:56 – Why Back Office Failure Kills 50% of Funds

James (29:56):

Half of hedge funds fail because of back office issues, not bad investments. Oversight and reporting matter.

31:30 – Institutional Reporting: NAV, Fair Value, Debt Share, REO Schedules

James (31:30):

Managers should report fair value, share of debt, and NAV-style updates so investors can complete REO schedules. This is standard in institutional finance.

32:11 – How to Work With James (Contact Info)

Eugene (32:02):

If anyone wants to reach you?

James (32:11):

I am available at [email protected]. J like James, B like Bohan, at stone like a rock and Han like Han Solo. Thank you for having me.

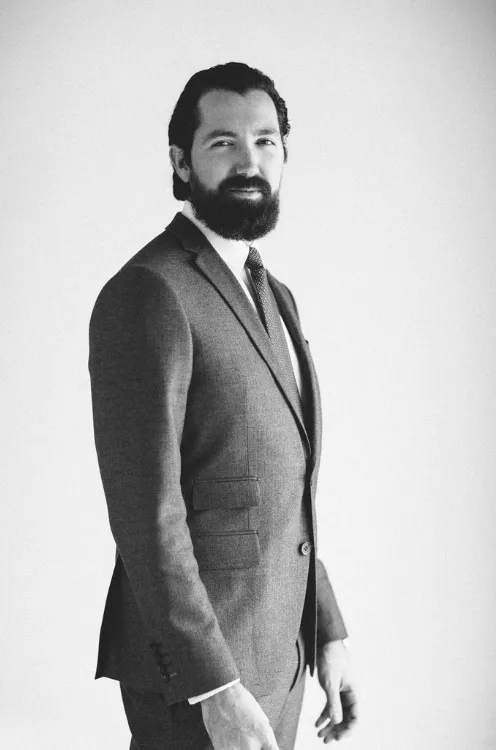

JAMES BOHAN – FOUNDER

James Bohan is a multi-faceted real estate professional, CPA, and entrepreneur. As the founder of Stonehan, he manages over $20MM of real estate while also providing accounting, tax, and fractional CFO solutions to real estate businesses, funds & syndicators . With more than 15 years’ of experience, he brings a wealth of knowledge in analyzing real estate transactions, tax structuring, creative financing techniques, and working capital management. Within the real estate investment management industry, Mr. Bohan is well regarded for his deep understanding of the complexities involved with a multitude of investment assets and complicated organizational structures.

Prior to Stonehan, James served as the inaugural employee and Chief Financial Officer of a Los Angeles-based real estate investment management firm, Mosaic Real Estate Investors. There, he played a key role in the firm’s growth and aligned the team through collaboration of management and stakeholders regarding strategic and financial planning, underwriting of debt and preferred equity investments, investor relations and reporting, risk management, compliance, cash flow, treasury, operating plans, tax matters, accounting, staffing, and policy development. Through his tenure with the company he oversaw all financial matters for the firm’s first ~$1B in loan commitments and the investor base grow to over 1,400 HNW investors and institutions.

Before joining Mosaic, James began his accounting career with the prestigious firm, Rothstein Kass, which was considered the premier boutique accounting firm for alternative investment vehicles: hedge fund, private equity, and venture capital firms. He worked there from 2010 until 2015 and during this time Rothstein was acquired by KPMG. James became an expert in real estate tax matters while offering tax and wealth management counsel to partnerships, trusts, REITs, corporations, and high-net-worth clients. He serviced private equity real estate firms with collective assets under management over $10B and consulted on over $2B of real estate transactions.

During this time from 2010 – 2015, James earned his California CPA license and was admitted to the Dollinger Master of Real Estate Development program at USC’s Sol Price School of Public Policy. He earned his Master’s in Real Estate Development (MRED) in 2015, graduating in the top 5% of his class and achieving an honorable mention for outstanding performance on the final comprehensive examination, all while continuing to work part-time for KPMG. He focused his undergraduate studies in Real Estate Finance and International Business, earning bachelor’s degrees in both Accounting and Business Administration from USC. His undergraduate academic achievements at USC included being accepted into the Marshall School of Business Honors Program and earning a spot on the Dean’s List. His collegiate social life centered around the Delta Chi Fraternity where he was elected to become a member of the executive committee. His summers were spent learning the nuances of real estate while serving internships in a variety of settings: residential mortgage lending, home building, and both corporate and onsite property management.

Mr. Bohan stays active professionally with involvement in the NIBCA, Information Management Network, and various other trade organizations. An avid traveler, he has visited over 40 countries, spent a semester studying abroad at Thammasat University in Thailand, and possesses dual citizenship in the United States of America and the Republic of Ireland.

⚡ Site Built with BAMF Technology ⚡