About Stonehan Accountancy

At Stonehan Accountancy, P.C. (Stonehan), we bring unmatched expertise in financial and business management tailored specifically for the real estate sector. We transcend the role of traditional CPAs, offering a sophisticated, CFO-level approach to your financial needs. In today's complex and rapidly evolving market, we offer sophisticated investors the financial guidance and assurance needed to meticulously manage their real estate investments.

WHY CHOOSE STONEHAN?

Unparalleled Depth of Analysis:

Our commitment to rigorous scrutiny and contrarian thinking ensures we delve deeper than most to vet investment opportunities and partners. This meticulous approach allows us to confidently identify lucrative ventures that meet your high standards.

CFO-Led Expertise:

With a leadership background that includes managing a $1B Real Estate Lending Fund registered with the SEC and serving over 1,400 investors, our CFO brings unparalleled financial acumen and strategic insight to your portfolio.

Comprehensive Asset Management:

We manage assets exceeding $25 million, showcasing our capability to handle substantial portfolios with precision and sophistication. Our experience ensures that every aspect of your investments is optimized for maximum return and minimal risk.

Innovative Real Estate Development:

As Co-GP/CFO of a Modular Real Estate Development project, we integrate financial expertise with hands-on development experience, providing a unique perspective that enhances your real estate investments.

Entrepreneurial Perspective:

Having started our own CPA practice, we infuse every client engagement with entrepreneurial energy and innovative thinking. This dynamic approach allows us to deliver exceptional service and proactive financial solutions.

Entrust Stonehan with your real estate financial needs and experience the benefits of working with a firm dedicated to optimal planning, implementation, management, and control of your real estate financial operations. Discover how Stonehan Accountancy, P.C. can transform the financial elements of your real estate business with precision and sophistication.

Our Core Values

Ruthless Skepticism

Meticulous Financial Planning

Comprehensive Vision

Contrarian Thinking

White-Glove Service

Ruthless Skepticism

Ruthless

Skepticism

Meticulous

Financial

Reporting

Comprehensive

Vision

Contrarian

Thinking

White-Glove

Service

Entrepreneurial

Execution

Real Estate Professional Status and Material Participation: What Fund Managers Get Wrong

Real Estate Professional Status remains one of the most powerful tax designations in the IRC, yet it is also one of the most misunderstood. Fund managers, syndicators, and investors encounter this concept often, but relatively few understand how it works, who qualifies, and what mistakes can undermine the benefit.

For fund managers in particular, the stakes are high. Real Estate Professional Status affects how depreciation can be used, how losses flow through to personal returns, and whether cost segregation studies create real tax value or trapped passive losses. It is often the dividing line between a strategy that works and a strategy that collapses under review.

This blog breaks down the fundamentals of Real Estate Professional Status, the material participation rules, how grouping works, and the errors fund managers commonly make.

Why Real Estate Professional Status Matters

Under normal rules, rental real estate is a per se passive activity. That means losses from rentals, including depreciation from cost segregation studies and bonus depreciation, can only offset passive income. They cannot offset W2 income, business income, or portfolio income.

For fund managers and active investors, this limitation can dramatically reduce the benefit of depreciation.

Real Estate Professional Status changes the rules. If a taxpayer qualifies as a real estate professional and materially participates in their real estate activities, those activities are no longer treated as passive. Losses can offset other forms of income, including high W2 earnings or active business income. This is why Real Estate Professional Status is considered by many tax strategists to be the most valuable tax designation available to real estate investors.

The Requirements for Real Estate Professional Status

The tax code requires two tests to qualify as a real estate professional:

The taxpayer must perform more than 750 hours of services in real property trades or businesses during the year.

More than half of the personal services performed in all trades or businesses during the year must be in real property trades or businesses.

These two tests must be satisfied for Real Estate Professional Status to apply. The 750 hours must be in qualifying real estate activities, and the taxpayer must spend more time in real estate than in all other work combined.

The rules are strict, and the IRS closely examines taxpayers who claim this status.

What Counts as a Real Property Trade or Business

Qualifying real property trades or businesses include:

Real estate development

Acquisition and due diligence

Construction

Property management

Brokerage

Leasing

Architecture and design

Certain activities do not qualify, including work as an employee unless the taxpayer owns more than 5 percent of the employer.

It is common for fund managers to assume their involvement in a fund automatically qualifies them. That is not correct. The nature of the work must match the definition in the code.

Material Participation: The Second Gate

Real Estate Professional Status alone is not enough. Even if a taxpayer satisfies the 750-hour requirement, they must also materially participate in the specific rental activities generating the losses.

Material participation is determined through seven tests, but the most common are:

More than 500 hours spent on the activity

More than 100 hours and no other individual works more hours

Participation that is regular, continuous, and substantial

This is where many fund managers fail the test. Working as a GP, raising capital, reviewing underwriting, or attending investor meetings often does not count toward material participation in rental real estate unless those activities directly relate to operating rental properties.

Grouping Elections: How Investors Bridge the Gap

For many taxpayers, the solution to the material participation requirement is a grouping election.

Grouping allows the taxpayer to treat multiple real estate activities as one combined activity. When activities are grouped, hours spent across the entire group are aggregated for determining material participation.

This is especially important for investors who:

Own multiple rental properties

Are part of several joint ventures

Hold GP interests in real estate funds

Participate in both active and passive real estate activities

By grouping these activities, investors can meet the 500-hour requirement collectively, rather than having to meet it for each property individually.

However, grouping must be done correctly and documented properly, or the IRS can reject the election.

The Passive Investor Strategy: Offsetting Passive Gains

For investors who do not meet Real Estate Professional Status or material participation, bonus depreciation is still valuable. It just functions differently.

Passive investors often use depreciation from new investments to offset gains from maturing passive investments. This creates what some practitioners call a “lazy 1031” effect, where new depreciation offsets the gain from the sale or disposition of older properties without triggering tax.

This strategy is particularly effective when:

Investors have multiple deals in different lifecycle stages

Old investments are realizing passive gain

New investments offer large first-year losses through cost segregation

Fund managers should educate their LPs on this strategy, as it creates meaningful value even for passive investors who cannot use losses to offset active income.

Real Estate Professional Status for Married Couples

The tax code allows a married couple to qualify for Real Estate Professional Status if either spouse satisfies the requirements. The hours of only one spouse are considered.

Many fund managers take advantage of this rule. For example, one spouse may have a demanding career in finance or tax that does not qualify, while the other spouse focuses on real estate operations. If the spouse meets the requirements, the couple benefits.

This approach is common among real estate investors and is frequently used to unlock greater depreciation benefits.

Why Many Fund Managers Fail to Qualify

Despite the benefits, many fund managers misunderstand these rules and incorrectly assume they qualify. Common mistakes include:

Believing GP work satisfies the 750-hour requirement

Claiming hours from consulting, lending, or capital raising

Failing to materially participate in rental activities

Forgetting to document hours contemporaneously

Assuming LP hours qualify, which they do not

Overestimating involvement in property operations

Ignoring the grouping election entirely

The IRS actively audits Real Estate Professional Status claims. Documentation must be accurate, detailed, and defensible.

Why Real Estate Professional Status Is So Valuable

When used correctly, Real Estate Professional Status allows taxpayers to:

Use bonus depreciation to offset active income

Generate tax-free cash flow

Recycle capital more quickly

Improve internal rates of return

Strengthen fund performance metrics

Allocate depreciation strategically

For fund managers building long-term portfolios, Real Estate Professional Status can be transformative.

How Fund Managers Should Approach REPS in 2025

With permanent bonus depreciation, expanded cost segregation opportunities, and increased return expectations from LPs, Real Estate Professional Status will become even more important.

Fund managers should:

Review qualification status for themselves and their spouses

Evaluate material participation documentation

Create grouping elections where appropriate

Coordinate with tax counsel on entity structure

Integrate REPS planning into acquisition strategy

Educate LPs about passive loss benefits

Prepare documentation before year-end

Real Estate Professional Status cannot be fixed retroactively. Planning must occur during the year, not after it closes.

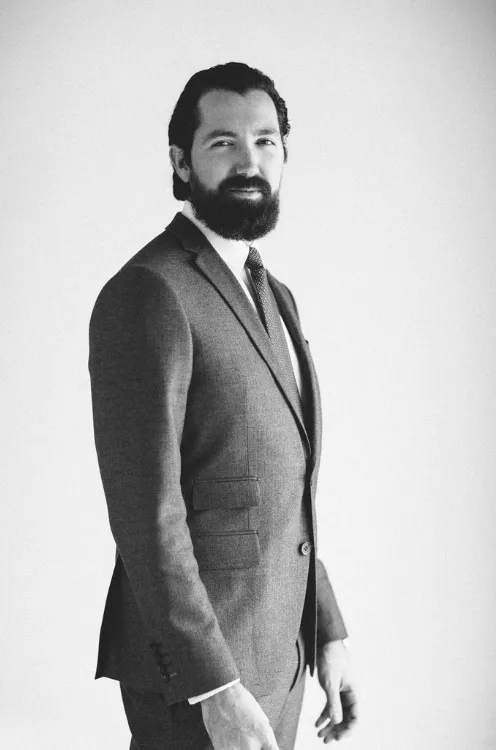

Book Your Tax Strategy Call with James

If you want to understand how Real Estate Professional Status and material participation apply to your fund, your investments, or your personal tax position, now is the time to take action. There is still time to review your documentation, evaluate grouping elections, and position your real estate activities for stronger tax outcomes before year-end. Once the year closes, these opportunities are gone.

Schedule Your Tax Strategy Session Now

JAMES BOHAN – FOUNDER

James Bohan is a multi-faceted real estate professional, CPA, and entrepreneur. As the founder of Stonehan, he manages over $20MM of real estate while also providing accounting, tax, and fractional CFO solutions to real estate businesses, funds & syndicators . With more than 15 years’ of experience, he brings a wealth of knowledge in analyzing real estate transactions, tax structuring, creative financing techniques, and working capital management. Within the real estate investment management industry, Mr. Bohan is well regarded for his deep understanding of the complexities involved with a multitude of investment assets and complicated organizational structures.

Prior to Stonehan, James served as the inaugural employee and Chief Financial Officer of a Los Angeles-based real estate investment management firm, Mosaic Real Estate Investors. There, he played a key role in the firm’s growth and aligned the team through collaboration of management and stakeholders regarding strategic and financial planning, underwriting of debt and preferred equity investments, investor relations and reporting, risk management, compliance, cash flow, treasury, operating plans, tax matters, accounting, staffing, and policy development. Through his tenure with the company he oversaw all financial matters for the firm’s first ~$1B in loan commitments and the investor base grow to over 1,400 HNW investors and institutions.

Before joining Mosaic, James began his accounting career with the prestigious firm, Rothstein Kass, which was considered the premier boutique accounting firm for alternative investment vehicles: hedge fund, private equity, and venture capital firms. He worked there from 2010 until 2015 and during this time Rothstein was acquired by KPMG. James became an expert in real estate tax matters while offering tax and wealth management counsel to partnerships, trusts, REITs, corporations, and high-net-worth clients. He serviced private equity real estate firms with collective assets under management over $10B and consulted on over $2B of real estate transactions.

During this time from 2010 – 2015, James earned his California CPA license and was admitted to the Dollinger Master of Real Estate Development program at USC’s Sol Price School of Public Policy. He earned his Master’s in Real Estate Development (MRED) in 2015, graduating in the top 5% of his class and achieving an honorable mention for outstanding performance on the final comprehensive examination, all while continuing to work part-time for KPMG. He focused his undergraduate studies in Real Estate Finance and International Business, earning bachelor’s degrees in both Accounting and Business Administration from USC. His undergraduate academic achievements at USC included being accepted into the Marshall School of Business Honors Program and earning a spot on the Dean’s List. His collegiate social life centered around the Delta Chi Fraternity where he was elected to become a member of the executive committee. His summers were spent learning the nuances of real estate while serving internships in a variety of settings: residential mortgage lending, home building, and both corporate and onsite property management.

Mr. Bohan stays active professionally with involvement in the NIBCA, Information Management Network, and various other trade organizations. An avid traveler, he has visited over 40 countries, spent a semester studying abroad at Thammasat University in Thailand, and possesses dual citizenship in the United States of America and the Republic of Ireland.

⚡ Site Built with BAMF Technology ⚡