About Stonehan Accountancy

At Stonehan Accountancy, P.C. (Stonehan), we bring unmatched expertise in financial and business management tailored specifically for the real estate sector. We transcend the role of traditional CPAs, offering a sophisticated, CFO-level approach to your financial needs. In today's complex and rapidly evolving market, we offer sophisticated investors the financial guidance and assurance needed to meticulously manage their real estate investments.

WHY CHOOSE STONEHAN?

Unparalleled Depth of Analysis:

Our commitment to rigorous scrutiny and contrarian thinking ensures we delve deeper than most to vet investment opportunities and partners. This meticulous approach allows us to confidently identify lucrative ventures that meet your high standards.

CFO-Led Expertise:

With a leadership background that includes managing a $1B Real Estate Lending Fund registered with the SEC and serving over 1,400 investors, our CFO brings unparalleled financial acumen and strategic insight to your portfolio.

Comprehensive Asset Management:

We manage assets exceeding $25 million, showcasing our capability to handle substantial portfolios with precision and sophistication. Our experience ensures that every aspect of your investments is optimized for maximum return and minimal risk.

Innovative Real Estate Development:

As Co-GP/CFO of a Modular Real Estate Development project, we integrate financial expertise with hands-on development experience, providing a unique perspective that enhances your real estate investments.

Entrepreneurial Perspective:

Having started our own CPA practice, we infuse every client engagement with entrepreneurial energy and innovative thinking. This dynamic approach allows us to deliver exceptional service and proactive financial solutions.

Entrust Stonehan with your real estate financial needs and experience the benefits of working with a firm dedicated to optimal planning, implementation, management, and control of your real estate financial operations. Discover how Stonehan Accountancy, P.C. can transform the financial elements of your real estate business with precision and sophistication.

Our Core Values

Ruthless Skepticism

Meticulous Financial Planning

Comprehensive Vision

Contrarian Thinking

White-Glove Service

Ruthless Skepticism

Ruthless

Skepticism

Meticulous

Financial

Reporting

Comprehensive

Vision

Contrarian

Thinking

White-Glove

Service

Entrepreneurial

Execution

The Cost of Waiting: Why Fund Managers Lose Millions in Compounding Savings

Fund managers obsess over fees, IRR, and investor distributions. But too many delay tax planning until it’s too late. They treat taxes as a compliance event in April, not a strategic lever in November.

That delay costs millions. Every year you wait, you don’t just overpay the IRS, you lose the ability to reinvest those savings and compound them into larger distributions and stronger fund performance.

At Stonehan, we see this pattern constantly. The most successful GPs aren’t just better operators, they’re better planners. They use tax strategy as a compounding growth engine, not a year-end afterthought.

The Real Cost of Delay

When you wait until April, you’ve already missed opportunities that can’t be recovered:

Elections. Grouping elections, depreciation allocations, and accounting method changes can’t be retroactively applied. If you didn’t file correctly, you’re locked out.

Structuring opportunities. Management companies left as Schedule C entities pay unnecessary self-employment tax year after year.

Material participation. Real Estate Professional Status and short-term rental classifications require contemporaneous time tracking. You can’t recreate hours after the year closes.

State tax reserves. If you distribute before reserving for state liabilities, you’ll face clawbacks or six-figure GP hits later.

Each of these missteps quietly chips away at returns, investor trust, and long-term wealth. and the longer you wait, the more it compounds.

Why Compounding Matters

Tax savings aren’t just about keeping more, they’re about growing more.

Saving $250 K in taxes this year doesn’t just mean $250 K more in your pocket. Reinvested at a 12 % IRR:

Year 1: $250,000

Year 5: $440,000

Year 10: $775,000

That’s a $525,000 difference created by timing alone. Waiting means that money never compounds. The IRS doesn’t refund opportunity.

Tax savings are capital. and capital compounds. Every dollar kept is a dollar that can be reinvested into the next acquisition, fund, or promote structure.

Proactive vs. Reactive: A Tale of Two Funds

Let’s look at how two funds play out over time.

Fund A: The Proactive Strategist

Engages Stonehan by Q3.

Aligns depreciation allocations under Section 704(b) so GPs capture real, usable deductions.

Implements PTET elections to bypass the federal SALT cap.

Reserves for state liabilities at disposition.

Qualifies for Real Estate Professional Status (REPS), unlocking full loss utilization.

Result: The GP saves hundreds of thousands in year-one taxes, LPs see higher after-tax distributions, and the fund raises capital faster because of its clean, strategic execution.

Fund B: The Reactive Filer

Waits until April.

Misses elections.

Files returns without adjusting allocations or structure.

Gets hit with unexpected state tax bills and delayed K-1s.

Result: LPs lose depreciation benefits, the GP absorbs costs, and investors question the sponsor’s operational discipline.

Over one deal, the difference might be six figures. Over a decade, it’s millions, and those millions compound into stronger AUM, faster fund launches, and higher confidence with institutional LPs.

The Investor Relations Impact

Your investors notice more than you think.

LPs expect sponsors to be sophisticated. When you fail to capture available deductions, they indirectly pay the price through smaller after-tax returns.

When LPs realize their GP didn’t claim obvious depreciation or failed to structure their management company properly, credibility erodes. And in an environment where capital allocators have options, credibility compounds just like returns.

Strong tax planning isn’t just about compliance, it’s a demonstration of stewardship. It shows investors that you’re not just chasing yield, but protecting every dollar of it.

Why Most CPAs Fall Behind

The issue isn’t that fund managers don’t care about tax strategy, it’s that they’re relying on CPAs who see tax season as a finish line, not a battlefield.

Most accountants:

File federal returns and move on.

Never review operating agreements for allocation opportunities.

Miss grouping elections and REPS eligibility.

Don’t coordinate with attorneys or administrators.

By the time they’re involved, the planning window is closed.

At Stonehan, we do things differently. We design Tax Battle Plans, comprehensive, forward-looking strategies built months before filing season.

The Battle Plan Difference

Our Tax Battle Plan approach helps fund managers turn tax strategy into a compounding advantage.

Here’s what it includes:

Entity chart reviews to identify inefficient structures and reallocate income.

Quarterly check-ins so no elections or timing opportunities slip through the cracks.

Audit-ready documentation to substantiate allocations, promote structures, and cost segregation studies.

Multi-state analysis to ensure compliance in every jurisdiction where you operate.

Real Estate Professional Status verification to maximize active loss utilization.

These aren’t tasks you can bolt on in April. They have to be implemented before December 31.

Our process is built around proactive coordination between attorneys, fund administrators, and management teams, the same integrated approach described in Stonehan’s Exemplary Real Estate Tax Services framework. It’s not just about filing returns, it’s about structuring wealth.

The Cost of Waiting, Quantified

Waiting a year doesn’t just mean missing one deduction, it means losing a decade of growth.

Let’s take two identical GPs:

GP 1 implements a strategy now. Saves $300K in taxes annually and reinvests it at 12% IRR.

GP 2 waits a year to plan.

After 10 years:

GP 1 has $4.6 million more in compounded after-tax capital than GP 2.

The takeaway: Tax planning doesn’t just save you money, it accelerates your growth curve.

Every month you delay planning is a month your capital stops compounding.

Frequently Asked Questions

Q: Can tax strategy really change my fund’s IRR?

A: Absolutely. Lowering your tax drag directly improves after-tax IRR. When depreciation allocations, REPS qualification, and entity elections are handled proactively, you’re not just saving, you’re performing.

Q: What if I already missed this year’s elections?

A: You can’t backdate elections, but you can prepare for next year. The key is starting before December 31, so your strategy is baked into your next tax cycle.

Q: How early should fund managers begin planning?

A: Ideally in Q3. By Q4, opportunities begin closing rapidly. Waiting until tax season is too late to make structural changes or capture bonus depreciation.

Q: What does a “Tax Battle Plan” actually include?

A: A full diagnostic of your entities, allocations, and state nexus exposures, plus an actionable roadmap that connects tax savings to fund growth objectives.

Final Takeaway: Tax Strategy Is Growth Strategy

Every year you wait to plan, you don’t just overpay the IRS, you underperform your own potential.

Taxes aren’t a static cost; they’re a controllable lever. The difference between a compliance mindset and a compounding mindset is millions in retained wealth over time.

The most successful fund managers don’t just manage money, they manage outcomes.

Act Before Year-End

With just weeks left in the year, now is the time to implement the strategies that can redefine your 2025 results. Once December 31 passes, most opportunities are gone.

📆 Book your Tax Strategy Call with James before year-end to:

Build your 2025 Tax Battle Plan

Reassess your fund’s entity structures and allocations

Confirm eligibility for Real Estate Professional Status

Lock in PTET elections and state tax savings before it’s too late

At Stonehan, we help fund managers design tax systems that compound over time, because long-term success isn’t built in April; it’s built now.

📲 Schedule Your Tax Strategy Session Now →

Don’t just plan for taxes. Engineer your advantage.

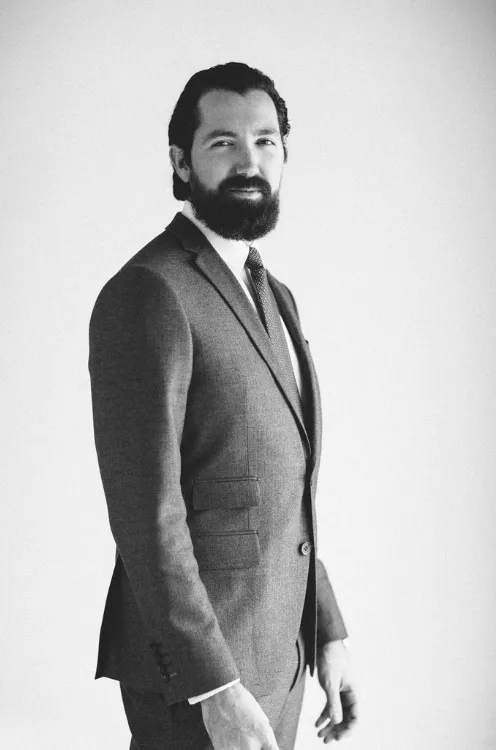

JAMES BOHAN – FOUNDER

James Bohan is a multi-faceted real estate professional, CPA, and entrepreneur. As the founder of Stonehan, he manages over $20MM of real estate while also providing accounting, tax, and fractional CFO solutions to real estate businesses, funds & syndicators . With more than 15 years’ of experience, he brings a wealth of knowledge in analyzing real estate transactions, tax structuring, creative financing techniques, and working capital management. Within the real estate investment management industry, Mr. Bohan is well regarded for his deep understanding of the complexities involved with a multitude of investment assets and complicated organizational structures.

Prior to Stonehan, James served as the inaugural employee and Chief Financial Officer of a Los Angeles-based real estate investment management firm, Mosaic Real Estate Investors. There, he played a key role in the firm’s growth and aligned the team through collaboration of management and stakeholders regarding strategic and financial planning, underwriting of debt and preferred equity investments, investor relations and reporting, risk management, compliance, cash flow, treasury, operating plans, tax matters, accounting, staffing, and policy development. Through his tenure with the company he oversaw all financial matters for the firm’s first ~$1B in loan commitments and the investor base grow to over 1,400 HNW investors and institutions.

Before joining Mosaic, James began his accounting career with the prestigious firm, Rothstein Kass, which was considered the premier boutique accounting firm for alternative investment vehicles: hedge fund, private equity, and venture capital firms. He worked there from 2010 until 2015 and during this time Rothstein was acquired by KPMG. James became an expert in real estate tax matters while offering tax and wealth management counsel to partnerships, trusts, REITs, corporations, and high-net-worth clients. He serviced private equity real estate firms with collective assets under management over $10B and consulted on over $2B of real estate transactions.

During this time from 2010 – 2015, James earned his California CPA license and was admitted to the Dollinger Master of Real Estate Development program at USC’s Sol Price School of Public Policy. He earned his Master’s in Real Estate Development (MRED) in 2015, graduating in the top 5% of his class and achieving an honorable mention for outstanding performance on the final comprehensive examination, all while continuing to work part-time for KPMG. He focused his undergraduate studies in Real Estate Finance and International Business, earning bachelor’s degrees in both Accounting and Business Administration from USC. His undergraduate academic achievements at USC included being accepted into the Marshall School of Business Honors Program and earning a spot on the Dean’s List. His collegiate social life centered around the Delta Chi Fraternity where he was elected to become a member of the executive committee. His summers were spent learning the nuances of real estate while serving internships in a variety of settings: residential mortgage lending, home building, and both corporate and onsite property management.

Mr. Bohan stays active professionally with involvement in the NIBCA, Information Management Network, and various other trade organizations. An avid traveler, he has visited over 40 countries, spent a semester studying abroad at Thammasat University in Thailand, and possesses dual citizenship in the United States of America and the Republic of Ireland.

⚡ Site Built with BAMF Technology ⚡