About Stonehan Accountancy

At Stonehan Accountancy, P.C. (Stonehan), we bring unmatched expertise in financial and business management tailored specifically for the real estate sector. We transcend the role of traditional CPAs, offering a sophisticated, CFO-level approach to your financial needs. In today's complex and rapidly evolving market, we offer sophisticated investors the financial guidance and assurance needed to meticulously manage their real estate investments.

WHY CHOOSE STONEHAN?

Unparalleled Depth of Analysis:

Our commitment to rigorous scrutiny and contrarian thinking ensures we delve deeper than most to vet investment opportunities and partners. This meticulous approach allows us to confidently identify lucrative ventures that meet your high standards.

CFO-Led Expertise:

With a leadership background that includes managing a $1B Real Estate Lending Fund registered with the SEC and serving over 1,400 investors, our CFO brings unparalleled financial acumen and strategic insight to your portfolio.

Comprehensive Asset Management:

We manage assets exceeding $25 million, showcasing our capability to handle substantial portfolios with precision and sophistication. Our experience ensures that every aspect of your investments is optimized for maximum return and minimal risk.

Innovative Real Estate Development:

As Co-GP/CFO of a Modular Real Estate Development project, we integrate financial expertise with hands-on development experience, providing a unique perspective that enhances your real estate investments.

Entrepreneurial Perspective:

Having started our own CPA practice, we infuse every client engagement with entrepreneurial energy and innovative thinking. This dynamic approach allows us to deliver exceptional service and proactive financial solutions.

Entrust Stonehan with your real estate financial needs and experience the benefits of working with a firm dedicated to optimal planning, implementation, management, and control of your real estate financial operations. Discover how Stonehan Accountancy, P.C. can transform the financial elements of your real estate business with precision and sophistication.

Our Core Values

Ruthless Skepticism

Meticulous Financial Planning

Comprehensive Vision

Contrarian Thinking

White-Glove Service

Ruthless Skepticism

Ruthless

Skepticism

Meticulous

Financial

Reporting

Comprehensive

Vision

Contrarian

Thinking

White-Glove

Service

Entrepreneurial

Execution

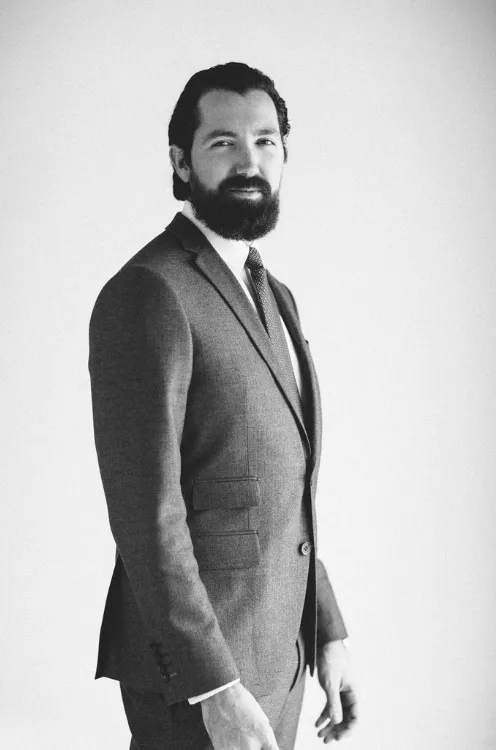

JAMES BOHAN – FOUNDER

James Bohan is a multi-faceted real estate professional, CPA, and entrepreneur. As the founder of Stonehan, he manages over $20MM of real estate while also providing accounting, tax, and fractional CFO solutions to real estate businesses, funds & syndicators . With more than 15 years’ of experience, he brings a wealth of knowledge in analyzing real estate transactions, tax structuring, creative financing techniques, and working capital management. Within the real estate investment management industry, Mr. Bohan is well regarded for his deep understanding of the complexities involved with a multitude of investment assets and complicated organizational structures.

Prior to Stonehan, James served as the inaugural employee and Chief Financial Officer of a Los Angeles-based real estate investment management firm, Mosaic Real Estate Investors. There, he played a key role in the firm’s growth and aligned the team through collaboration of management and stakeholders regarding strategic and financial planning, underwriting of debt and preferred equity investments, investor relations and reporting, risk management, compliance, cash flow, treasury, operating plans, tax matters, accounting, staffing, and policy development. Through his tenure with the company he oversaw all financial matters for the firm’s first ~$1B in loan commitments and the investor base grow to over 1,400 HNW investors and institutions.

Before joining Mosaic, James began his accounting career with the prestigious firm, Rothstein Kass, which was considered the premier boutique accounting firm for alternative investment vehicles: hedge fund, private equity, and venture capital firms. He worked there from 2010 until 2015 and during this time Rothstein was acquired by KPMG. James became an expert in real estate tax matters while offering tax and wealth management counsel to partnerships, trusts, REITs, corporations, and high-net-worth clients. He serviced private equity real estate firms with collective assets under management over $10B and consulted on over $2B of real estate transactions.

During this time from 2010 – 2015, James earned his California CPA license and was admitted to the Dollinger Master of Real Estate Development program at USC’s Sol Price School of Public Policy. He earned his Master’s in Real Estate Development (MRED) in 2015, graduating in the top 5% of his class and achieving an honorable mention for outstanding performance on the final comprehensive examination, all while continuing to work part-time for KPMG. He focused his undergraduate studies in Real Estate Finance and International Business, earning bachelor’s degrees in both Accounting and Business Administration from USC. His undergraduate academic achievements at USC included being accepted into the Marshall School of Business Honors Program and earning a spot on the Dean’s List. His collegiate social life centered around the Delta Chi Fraternity where he was elected to become a member of the executive committee. His summers were spent learning the nuances of real estate while serving internships in a variety of settings: residential mortgage lending, home building, and both corporate and onsite property management.

Mr. Bohan stays active professionally with involvement in the NIBCA, Information Management Network, and various other trade organizations. An avid traveler, he has visited over 40 countries, spent a semester studying abroad at Thammasat University in Thailand, and possesses dual citizenship in the United States of America and the Republic of Ireland.

⚡ Site Built with BAMF Technology ⚡