About Stonehan Accountancy

At Stonehan Accountancy, P.C. (Stonehan), we bring unmatched expertise in financial and business management tailored specifically for the real estate sector. We transcend the role of traditional CPAs, offering a sophisticated, CFO-level approach to your financial needs. In today's complex and rapidly evolving market, we offer sophisticated investors the financial guidance and assurance needed to meticulously manage their real estate investments.

WHY CHOOSE STONEHAN?

Unparalleled Depth of Analysis:

Our commitment to rigorous scrutiny and contrarian thinking ensures we delve deeper than most to vet investment opportunities and partners. This meticulous approach allows us to confidently identify lucrative ventures that meet your high standards.

CFO-Led Expertise:

With a leadership background that includes managing a $1B Real Estate Lending Fund registered with the SEC and serving over 1,400 investors, our CFO brings unparalleled financial acumen and strategic insight to your portfolio.

Comprehensive Asset Management:

We manage assets exceeding $25 million, showcasing our capability to handle substantial portfolios with precision and sophistication. Our experience ensures that every aspect of your investments is optimized for maximum return and minimal risk.

Innovative Real Estate Development:

As Co-GP/CFO of a Modular Real Estate Development project, we integrate financial expertise with hands-on development experience, providing a unique perspective that enhances your real estate investments.

Entrepreneurial Perspective:

Having started our own CPA practice, we infuse every client engagement with entrepreneurial energy and innovative thinking. This dynamic approach allows us to deliver exceptional service and proactive financial solutions.

Entrust Stonehan with your real estate financial needs and experience the benefits of working with a firm dedicated to optimal planning, implementation, management, and control of your real estate financial operations. Discover how Stonehan Accountancy, P.C. can transform the financial elements of your real estate business with precision and sophistication.

Our Core Values

Ruthless Skepticism

Meticulous Financial Planning

Comprehensive Vision

Contrarian Thinking

White-Glove Service

Ruthless Skepticism

Ruthless

Skepticism

Meticulous

Financial

Reporting

Comprehensive

Vision

Contrarian

Thinking

White-Glove

Service

Entrepreneurial

Execution

Real Estate Legacy Playbook: CPA on Taxes, Back Office Discipline & Raising Investor-Minded Kids

Featuring: Kenny Johnson (The Invested Fathers Podcast) & James Bohan, CPA, MRED

This conversation originally aired on The Invested Fathers Podcast, hosted by Kenny Johnson, a show focused on the intersection of leadership, parenting, and building businesses that last across generations. Kenny invited CPA, outsourced CFO, and fourth-generation real estate developer James Bohan to discuss how tax strategy, stewardship, back office discipline, and fatherhood come together in the real estate world.

James explains how growing up in a real estate family shaped his investment mindset, why accounting became the foundation for his success, how he vets operators before investing, and what he believes fathers must teach their children if they want them to think like owners instead of consumers.

This conversation blends technical real estate wisdom with legacy-focused insights for leaders who want to build something that lasts.

Summary:

Legacy is built through disciplined operations, wise stewardship, intentional parenting, and a foundation rooted in strong financial understanding. In this episode, James explains:

Why the CPA path is the ultimate foundation for real estate

How growing up discussing deals at the dinner table shaped his mindset

How elite families apprentice their kids through simple conversations and site visits

Why speculation (rent growth assumptions) destroys investor wealth

Why 50 percent of funds fail because of back office issues, not bad deals

How he vets operators before placing LP capital

Why stewardship reframes wealth, debt, and Christian entrepreneurship

How traditional household roles helped him focus and build

Why apprenticeships inside the family business create investor-minded kids

How intentional parenting creates generational thinkers, not wage earners

This is a legacy-forward episode for fund managers, GPs, family offices, and fathers who want their children to grow up understanding ownership, discipline, and purpose.

Watch the Full Episode:

FAQ's

1. Why is CPA the best foundation for real estate investment?

Because accounting is the language of business. It allows operators to understand cash flow, structure deals, and evaluate risk better than almost any other background.

2. Why do elite real estate families apprentice their kids early?

Kids absorb information quickly. Exposure to deals, site visits, and business conversations builds an investor mindset naturally.

3. Why do 50 percent of funds fail?

Not because of bad deals, but because of poor back office operations: lack of controls, sloppy reporting, weak systems.

4. How does faith shape James’s view of wealth?

He views himself as a steward, not an owner, managing God’s capital with discipline and humility.

📞 Book a Tax Strategy Call with James:

https://calendly.com/jamesbohan/book-a-call

📨 Connect With James:

LinkedIn: James Bohan, CPA, MRED

Instagram: @jamesbohancfo

Website: stonehan.com

Chapter Breakdown With Timestamps:

00:00 – Teaching Kids Business Early and Seeing Real Estate Supply & Demand

00:42 – Welcoming James and Introducing His Expertise

00:56 – How James Entered the CPA and Real Estate Fund World

01:53 – Growing Up in a Real Estate Family

02:17 – Real Estate as a Leveraged Bet on Inflation

02:54 – Family Values, Survival Mentality, and Wealth Building

04:04 – Following Both Parents’ Career Paths (CPA + Developer)

05:13 – Why a CPA License Builds Unlimited Career Options

06:34 – Common Mistakes Real Estate Investors Make

07:44 – Back Office Failures and Why Operators Collapse

09:02 – What New Investors Should Ask Before Investing

10:12 – How James Chooses Who to Invest With

10:32 – James’ Own Deals and Raising a Mountain States Fund

11:19 – Marriage, Faith, and Preparing for Fatherhood

12:07 – Christianity, Wealth, and Stewardship

14:08 – How Faith Changed His Life, Values, and Career

15:09 – Debt, Lending, and the Christian Perspective

16:18 – Traditional Marriage Roles and Increased Productivity

17:36 – How Marriage Shifted His Time and Priorities

19:30 – Apprenticeship, Fatherhood, and Involving Kids in Business

20:37 – Lessons From Childhood: Seeing Real Estate Everywhere

21:14 – Becoming a Better Father and Role Model

21:53 – Conflict, Failure, and Growing Through Hard Moments

22:31 – How to Follow and Contact James

Original Episode:

This conversation originally aired on The Invested Fathers Podcast.

Watch here: https://www.youtube.com/watch?v=ijFz6ObBXpI

Full Transcript:

00:00 - Teaching Kids Business and Seeing Supply and Demand Young

James (00:00):

As soon as you can under age, try to get your kids involved with your business or your profession as much as possible so they can start learning. Kids can be smarter than you give them credit for, and I just remember my time growing up, just driving around with my dad and just we'd be talking about real estate and like pointing out different things.

James (00:19):

I remember. He tells me the story. As a kid, I was like 10, 12 years old, and we got the one one intersection and there's three gas stations all around. I'm like, why are there three here like this? The people going this way can hit that one and that one they call it. And like lo and behold, a couple years later, one of 'em goes bankrupt and out, and my dad loves to tell that story.

I was even just looking around as a kid and understanding kind of supply and demand of real estate.

00:42 - Welcoming James and Positioning Him as the Expert

Kenny (00:42):

James Bohan, how are you today, sir?

James (00:47):

I'm great, Kenny. Thanks for having me on your show.

Kenny (00:49):

We have a for sure expert in the building on all things tax related, specifically I would say in the real estate sector as well.

Kenny (00:56):

Those overlapping.

00:58 - James’ Background as a CPA and Outsourced CFO in Real Estate

James (00:58):

My main business is primarily at being a CPA and outsource CFO for real estate investors and private equity fund managers. I got into this space about 13, 14 years ago. I've had my CPA license since 2011, and I started my career at the firm called Rothstein ca, which was a specialist in the alternative investment space.

James (01:16):

And what we meant by alts back then was your hedge. Your private equity, your real estate funds, stuff that wasn't traditionally stocks and bonds got categorized in this idea of alts. So I grew up in a real estate family, always learned about real estate at the dinner table. But when I started my professional career, I understood how fund managers and private equity was using the real estate asset class and layering these fund models around it.

James (01:41):

And so my career was really started going in and doing the taxes and structuring for a lot of these private equity real estate funds. I learned this other side of the business that I didn't get just growing up in a family of real estate developers.

01:53 - Growing Up in a Developer Family and Betting on Inflation

Kenny (01:53):

That's awesome. So you just talking about the dinner table there, what was it about real estate that your family was doing?

Kenny (01:59):

Is your dad buying real estate as well or was it just a investing type of family dinner?

James (02:06):

They were developing a lot. We moved out to Las Vegas in the nineties 'cause my dad was developing some single family homes out there, which eventually rolled into developing some multi-family buildings. I remember having some conversations with my dad and.

James (02:17):

We just look at real estate as having a leveraged bet on inflation and a bet on the Federal Reserve doing what the Federal Reserve does. There's a lot of wisdom out there that says, don't fight the Fed. And I feel like real estate is one of the main beneficiaries of Federal Reserve policy where they continue to inflate the money supply, and as a result, hard assets that you can't print more of just have their price load up in relation to the way that the monetary economy works.

Kenny (02:44):

Yeah. Wow. So you and dad now did, was there a lot of other brothers and sisters in your family where this was just like a spirited conversation, like ongoing all the time? Or was it like a you and dad thing?

James (02:54):

It was more of a me and dad thing. I have a younger brother who wasn't really as interested in the family business.

James (02:59):

We've had talks and over the years they get to some level of wealth and I asked my dad like, why are you working so hard? What are you doing this for? I said initially it was for survival. After he graduated college, he was working two or three jobs living out of his car, washing dishes, and so a lot of his ethos came from this survivor mentorship, and then after that he's saying he's working so hard to pass it along to my brother and I, so we don't have to go through some of the same strife that he did.

Kenny (03:27):

Yeah. Wow. I think that's a great way to build that foundation of values in regards to, listen, I'm not just. Trying to get a super nice car in the driveway here. We're trying to survive.

James (03:39):

Yeah.

Kenny (03:40):

If you can take that same mentality and put it toward building real estate or development or building a team, I feel like there's just no ceiling on how far you can go.

Kenny (03:49):

Tell me a little more about your dad. Just this being the invested fathers, I always feel like that's a great insight into who you are. James, as dad was like this, so this is how I turned out because of that, or I went another direction because things were like this.

04:04 - Following Both Parents’ Career Paths and Why the CPA Is “Golden”

James (04:04):

Yeah, it's pretty interesting. So I followed both my dad and my mom's careers pretty lockstep in a couple different ways, which is really funny.

James (04:12):

So my dad went to USC and ended up working for one of his professors in real estate, and my mom was a CPA, so I became a CPA and then went and got my master's in real estate in development from USC, and then ended up working for one of my professors as the CFO. So it's crazy and weird to me how I've both dual tracked both of my parents' careers into one career for myself.

James (04:35):

It's pretty wild, and some of the best advice I got from my dad growing up was to get your CPA license and then you'll be able to write your ticket to do anything you want in life. I never really quite understood what that was. Your young 20-year-old kid graduating from college and you're like, I don't wanna do accounting.

James (04:53):

It's hard work. It's hard hours, it's unappreciated, it's low pay compared to tech or finance, but it was such a good basis and foundation for being in business that I am starting to encourage other people now that, hey, if you wanna be a successful in life or if you want to have a career in business, I highly recommend being an account and getting your CPA 'cause.

James (05:13):

It's really hard to mess it up. Once you have that and thinking about where career paths can go. With a CPA and accountant, you can pick whatever industry or field that's really interesting to you. So for me, it was real estate and I was able to work my way up, have all real estate clients, learn the business inside and out from my clients.

James (05:32):

I had the benefit and blessing of learned it from my family as well, but for those that don't, you're able to get a very similar experience to I had growing up by being a CPA and accountant. For businesses that you would eventually wanna own or work in yourself. So a typical accounting career is where you could work two to three, to four to five years, get yourself up to a manager level.

James (05:51):

Then you're really interacting with your clients on a very personal and in-depth basis. So when they might have a hiring need for their own internal CFO or accounting manager, the CPA that's working in public accounting for 'EM is probably the number one fit for that job. So it's just a matter of determination and being willing to suffer through accounting classes and getting that CPA exam.

James (06:15):

Passed and getting, and then working for two years to get your license. If you suffer enough doing this, then you're gonna have an easier life on the back end. And being where I'm at now and providing for my wife and our eventual family and kids, having the CPA license is literally like gold because I know I will always be able to provide for my family one way or another.

06:34 - Biggest Investing Mistake James Sees: Speculating on Rent Growth

Kenny (06:34):

Yeah. That's awesome. You mentioned before we recorded, one of the main reasons why I focused on real estate is because I kept seeing. People do it wrong and it got me frustrated to the point of I just need to like rather do this, be the leader to maybe invest. Maybe the question is, what are some common mistakes or some mistakes that you've seen on your end?

Kenny (06:59):

And because of seeing those done, whether how the operator structured something, what have you done because of it?

James (07:08):

One thing I see that people invest in real estate do wrong is that they're just baking pre and hoping on rent growth to meet their pro forma. I would consider that speculation. A lot of time when I'm investing in real estate, I wanna make sure there's forced equity in the project from the jump.

James (07:24):

If it's only an 80% occupancy building, and I know I can go in with proper. Property management measures, I can jump it to 90, 95%. That's a solid NOI growth and that solid value being delivered and forced equity from the jump. If you just buy something and hold it and hope for five to 10 years now, it'll be worth more.

James (07:44):

That's speculation in my mind. So I think looking at projects and making sure, hey, where is the value I can add to this is something paramount when you're looking to make money in real estate. The other thing I see, Ann. This is a study done on hedge funds, and so I'm not sure how applicable it is to real estate, but I'm sure there are some overlaps.

James (08:05):

It was a study that 50% of hedge fund managers didn't fail because they made bad investments. They failed because they had a bad back office. And what that means to me is do they have an investor portal? Do they have an outside CPA? Is that CPA competent? Do they know about real estate? Do they have the proper attorney counsel?

James (08:26):

What's the internal controls like? Is the contractor or the controller stealing money? A very easy tip is the person who's cutting the checks. Shouldn't be the person who's accounting for the checks. And so just having some of these basic internal controls is important, and it's like an afterthought to a lot of fund managers, but I think as people should have a very disciplined approach to managing other people's money, I think this idea of having a fully established back office, whether in-house or outsourced, is important.

James (08:56):

And it shows investors that they're treating their capital investment properly and it's being looked after.

09:02 - How James Evaluates Operators Before Investing With Them

Kenny (09:02):

Awesome. I get asked a lot. So if you're talking to a new investor, I would say one of the most common things they say is, I don't even know what to ask. What should I, what should my due diligence be?

Kenny (09:12):

Like, what, how would you direct me to say this is a good deal? I mean, I like you Kenny. I think I trust you with a hundred thousand dollars, but can you help gimme some things that I can vet? So it seems like you have lived that in regards to, hey, we're looking at the underwriting, but also let's look at the staffing, let's the process, the attorneys.

Kenny (09:32):

All those things that just can mitigate some of these potential pitfalls. Is that right?

James (09:38):

Yeah, absolutely. It's something that I do with my CPA practice. I've invested with some of my clients before, and their attitude towards the back office is definitely one of the considerations I have if I'm gonna be placing money with one of them.

Kenny (09:51):

Yeah, that was my next question was how do you choose who to invest with? You've sat on the peak behind the curtain with some of these operators to say, Hey, well what exactly are we doing here? And maybe have seen a lot. Are there certain, I'm sure there's a lot of things, but what are some of the highlights on what you look for to who to invest with?

James (10:12):

I think track record is important. I think their attention to detail, how much they care about their back office, they're reporting to investors. And then, 'cause if the person really doing it for fees, is their long-term vision aligned with mine? Those are some of the questions I ask.

10:26 - Launching His Own Fund in the Mountain States

Kenny (10:26):

Cool. And your own investing career, 'cause you have your own apartments and things as well.

Kenny (10:32):

Is that something that you're right now focusing toward in on, like bringing other investors with you, like other fund funds, managers or private capital?

James (10:42):

Yeah, so I'm in the process of putting together a small fund right now to capitalize on some of the opportunities I'm seeing in the mountain states.

James (10:48):

Which are the fastest growing economies in the United States. We've just been doing it with our own family so far. But as we've built out the track record here, we're starting to get our fund documents together with the attorneys to start being ready to capitalize on what I see as coming around the bend here.

11:07 - Newly Married, Preparing for Fatherhood, and Rebuilding His Firm Around Family

Kenny (11:07):

Awesome. Okay. I'm gonna shift a little bit of the conversation. Tell us a little bit about your fatherhood experience or lack of fatherhood thereof.

James (11:19):

So, I just got married about a year ago. My wife and I are practicing Christians, and we're waiting for the Lord to bless us with our first child. Hopefully it'll happen in the next year.

James (11:29):

Right now we're just trying to make sure we're getting all our lives aligned and ready to be able to welcome a child into the world. I've been working really hard on getting my accounting firm staffed up appropriately where I'm not working 16, 18 hours a day. So when we do have a family, I'll be able to be more present for them.

12:07 - Christians, Wealth, and Stewardship Instead of Guilt

Kenny (12:07):

Yeah, thanks for mentioning. I feel that Christians in the workplace have a certain stigma. To be honest I've lived in a bubble, but I've been around a certain Christian college, Christian business environment, and it just felt like, Hey, you can't be rich. A Christian, like there's a conflict of interest there.

Kenny (12:25):

And I know that's a myth, and I think that's just still something that maybe I'm a minority in thinking that. But in your experience being a Christian in a secular environment, how has your experience been in being a Christian and also have you had certain views given to you that you feel like you've been trying to break?

James (12:43):

Yeah, very good question. So I'm a newer Christian in my faith. I was raised Catholic, but that didn't stick to me. And then. I wanna explore Buddhism and all that other stuff. But the past 3, 4, 5 years has been real evidence to me of the truth of the gospel. And so I think the idea that Christians can't be rich.

James (13:00):

I don't think that's biblical. I think there are rich Christians or rich biblical figures in the Bible, whether they were Christian or not, depending on when that chapter was written. God wants to bless us, and I think the ultimate way to look at it at the end of the day is that we're gonna be custodians of this wealth.

James (13:17):

It's not ours. We don't get to take it with us. We just get to manage it and be custodians and servants of that wealth. While we're here on this earth. And so I think taking the perspective, it's not mine, it's God's, and I am the servant and custodian on behalf of this wealth that he has blessed me with.

James (13:32):

One helps keep you humble and two reminds you that you can be rich and. Does God wanna make a non-Christian or a Christian Rich is a person in this world gonna have more power or more influence, or you'd be able to impact more people's lives, whether they're rich or poor? You know, you definitely can in both ways.

James (13:49):

Service can happen in a lot of different ways, but if you're rich in a Christian, you're able to push the envelope through financial means and donate, or start charities or endeavors that can impact millions of people. I don't think there's anything wrong at all for Christians to be rich, especially when you adopt the mindset that it's all.

James (13:52):

His to begin and end with.

14:08 - Faith Journey, Moving to Idaho, and Wrestling With Lending as a Christian

Kenny (14:08):

Totally agree. Yeah. I like to think of it like you, your hands are open, so I've got places, things in your hands great. You know, tighten 'em up and no, don't take it back. But it takes some away, it could be billions of dollars. It could be what you just need to have food for this week kind of deal.

Kenny (14:27):

And I love that. And that's so encouraging to hear about the new Christian. You've went a couple different routes in regards to trying to figure out where is peace. Where is it at in regards to my soul and how should I be living? I would love to explore, if you don't mind, the relationships you've had before the being a Christian and now after.

Kenny (14:35):

What have you seen? How have some of those maybe relationships in the business world been affected through a big change of yourself?

James (14:35):

I haven't really noticed any glaring changes, and it's really hard to answer that question because over the past four or five years as becoming Christian, there was the whole pandemic that happened and I moved outta California and moved to Idaho.

James (15:09):

So just like a complete change in total lifestyle, the Lord has blessed me with a small farm that I live on up here. And so it's just been a completely different life and. I haven't really noticed any difference in my business interactions. The one thing for me was that I used to be the CFO of a debt fund, and we lent a lot of money out to real estate developers.

James (15:29):

So I had to do some more understanding and reading to see if money lending was an acceptable practice under Christianity because I had gotten some different understandings or feedbacks. But talking with my pastor helped me understand that in the business context, so long as it's not usy, their interpretation and mine as well as that lending is not haram and is allowed under the Christian faith.

15:50 - Debt, Mortgages, and Avoiding Extreme Positions

Kenny (15:50):

Yeah. That's really interesting. I think one of the things that I hear a sort a buzz thing is, you know, the Bible would say, be in debt to no man. And I feel like you could take that and be like, is a mortgage a debt? Am I doing something? Do I have to buy a house in cash? To like abide by that verse. From your profession and being a new Christian, has that been something you've journeyed down yet?

James (16:02):

I'm gonna take the same stance as you. I'm not an expert. I'm willing to have a conversation on it. Yeah. And so I'm just saying it's like a spectrum. If you get into a bunch of credit card debt to live outside your means then you're gonna be stressing out. You're gonna be unhappy, and God doesn't want that for you.

James (16:18):

Right. Whereas if you take on zero debt and you're Dave Ramsey, right. And you tell him, Dave Ramsey. If I lend you a billion dollars at 1%, will you take it? No, I won't take it. I don't take debt. Dave Rams. I can take that billion dollars and put it in T-bills at 3% and I'm getting 2% spread on billion dollars, but Right.

James (16:38):

No, I won't do it. I think there's extremes there. Yeah. I think the idea with the home and just honestly the root of the word mortgage is a little concerning. It's a Latin word, more to death gauge grip. Literally have a death grip over you to pay for your housing. I think if you can own your home free and clear, that's obviously a great endeavor.

James (16:54):

It's not achievable or feasible for everyone. I have a mortgage on my house as well. And so I think just being prudent and proper with it. When you go into debt to live outside of your means, I think that's when you start to challenge God and say, Hey I need and want all this, but I haven't earned it yet.

James (17:05):

And so you borrow against credit, which I don't think is in line with what the Bible is trying to get at and dictate how you should live your life in a way that's in harmony with God.

17:13 - Traditional Marriage Roles and Getting More Focused at Work

Kenny (17:13):

Thank you. James, you've been married for a year, 13 months actually you mentioned before and there's that idea of.

Kenny (17:36):

Legacy and values, and you mentioned already like working 16, 18 hours a day might have been the norm for a while. I've heard you on one of the coaching calls and you were spitballing so many things that I just did not understand. Not because you weren't saying it, but because I felt like you were very knowledgeable on structuring these different things in the business world.

Kenny (17:55):

So I'll just say is you've qualified yourself very much in your business role as you take. Maybe some shifts in priorities As family starts to grow, obviously you're wanting to spend time with your wife. What are some things that are really important to you that the older James who had all the time in the world to work on the business would shift?

Kenny (17:56):

Now

James (17:56):

I've actually been able to focus and work more. My wife and I have adopted and come to the same conclusion, or we wanna be on the same page of having a traditional marriage. Where we like to say she's the domestic engineer and I'm the provider. I get the house, she makes the home. Simple things like that, that I think have been lost in this secular society.

James (18:16):

So honestly, over the past year, I've been able to just focus and lock in on work a little bit more knowing that she's gotten the house on lock.

Kenny (18:24):

Excellent. So now that you guys have found each other, the different roles that you would say, you can now focus more on the job versus before you might've been like keeping up with the house more or doing things that you were doing two roles.

Kenny (18:39):

Now you're like, Hey, here's the roles. This is working really well for us. This is what I feel like it should be. And you've been able to be more productive.

James (18:49):

Yeah, absolutely. Like before, when I was a single man, you'd be wasting time chasing women. And now all that time I can spend on going on a date night with her once a week and then just pour the rest of that energy into being productive for her and me and the family.

19:04 - Apprenticing Your Kids Inside Your Business

Kenny (19:04):

Yeah. You touched a little bit on the idea of secular mindsets, of roles and whatnot. One of the questions I ask on this podcast is, what are some problems we see with, that you see with other dads? Maybe not necessarily dads has to be the word there, but. A fatherly role or like mentors? What are some things that you're like, man if we could just get this in order, I really feel like the world would be a better place.

James (19:30):

Yeah, really good question. I feel like if Dads had more time to apprentice their children and be in their lives, I've really tried really hard to set up my life to just be different and really own my own time so I can be there for my family in the future. And I think. When men go outside the home for eight to 10 to 12 hours a day, they're losing a lot of time where they can interact with and apprentice their children.

James (19:53):

And so I think as soon as you can in an early age, try to get your kids involved with your business or your profession as much as possible so they can start learning. Kids can be smarter than you give them credit for, and I just remember my time growing up, just driving around with my dad and just.

James (20:11):

We'd be talking about real estate and like pointing out different things. I remember he tells me this story as a kid, I was like 10, 12 years old and we got the one one intersection and there's three gas stations all around. I'm like, why are there three here like this? The people going this way can hit that one and that one they call it.

James (20:27):

And like lo and behold, a couple years later, one of 'em goes bankrupt and now, and my dad loved to tell that story. I was even just looking around as a kid and understanding kind of supply and demand of real estate.

Kenny (20:37):

No, I love that. I think that's really awesome advice. As dads, how can you bring in your kids into your work?

Kenny (20:44):

Does it have to be this, like completely separate? No, he is, it's too hard to explain or he'll just get in the way, or, I don't know, whatever it is, why not bring him in and have a little apprentice that you're gonna be with for the next a hundred years, however long you're alive here, and just get that relationship nurtured.

21:14 - Truth and Grace in Family Leadership and Using Conflict to Grow

Kenny (21:03):

Okay. From your firsthand experience, what's something that. We could be doing today that would help us be a better rather role model, mentor or dad.

James (21:14):

I'm gonna say to follow Jesus's example as much as possible, and that is to bring in a hundred percent truth and a hundred percent grace into our interactions with everyone, especially our family.

Kenny (21:25):

Have you experienced, this is something that I'm sure husbands face all the time, but. You have an argument or you do something that requires humility, asking forgiveness. Has there been something that you've seen God working in your life or a huge victory on something where you were like, man, this was really hard to do.

Kenny (21:45):

I did it. Some story of sort like reconciliation or some, Hey, I messed up and this is what I did because of it, and I'm better because of it.

James (21:53):

Give any specific examples. Right now, but I think it's just adopting the mindset that failures can lead to becoming be better. When you come onto this planet, you're destined to fail, and it's how you get over those failures and build up towards the success is important.

James (22:08):

I think when you get into arguments with your spouse or your family, they can lead to help resolve issues that may have not been talked about, and a way for you to address and fix problems so you can have a healthier family and marriage.

22:31 - Where to Follow and Work With James

Kenny (22:24):

Yeah, absolutely. Wrapping up, James, tell our audience, number one, what are the best ways to track what you're doing, the ways they could follow you?

James (22:31):

Thanks, Kenny. So I'm pretty active on LinkedIn. You can connect with me there, James Bohan CPA Ed. Then also my website has a lot of information about what we're up to. That's www.stonehan.com That's stone like a rock. And Han like Han Solo.

Kenny (22:48):

Perfect. James, thanks for being with us today, buddy. We'll keep track of where you're going and thanks for all your time.

James (22:54):

Thanks, Kenny.

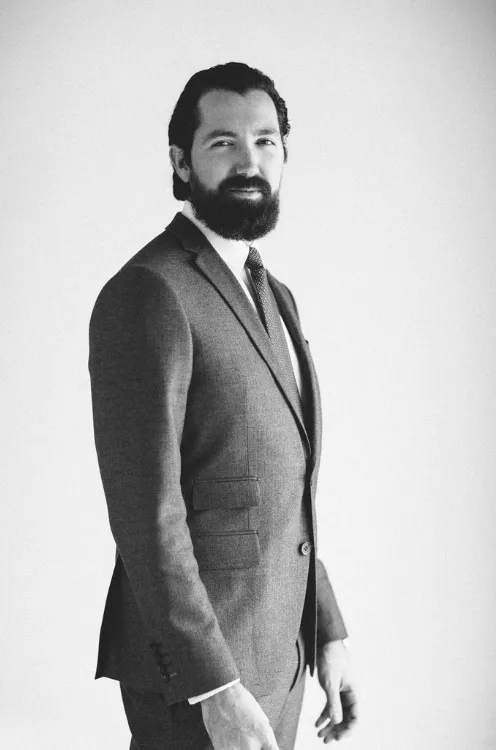

JAMES BOHAN – FOUNDER

James Bohan is a multi-faceted real estate professional, CPA, and entrepreneur. As the founder of Stonehan, he manages over $20MM of real estate while also providing accounting, tax, and fractional CFO solutions to real estate businesses, funds & syndicators . With more than 15 years’ of experience, he brings a wealth of knowledge in analyzing real estate transactions, tax structuring, creative financing techniques, and working capital management. Within the real estate investment management industry, Mr. Bohan is well regarded for his deep understanding of the complexities involved with a multitude of investment assets and complicated organizational structures.

Prior to Stonehan, James served as the inaugural employee and Chief Financial Officer of a Los Angeles-based real estate investment management firm, Mosaic Real Estate Investors. There, he played a key role in the firm’s growth and aligned the team through collaboration of management and stakeholders regarding strategic and financial planning, underwriting of debt and preferred equity investments, investor relations and reporting, risk management, compliance, cash flow, treasury, operating plans, tax matters, accounting, staffing, and policy development. Through his tenure with the company he oversaw all financial matters for the firm’s first ~$1B in loan commitments and the investor base grow to over 1,400 HNW investors and institutions.

Before joining Mosaic, James began his accounting career with the prestigious firm, Rothstein Kass, which was considered the premier boutique accounting firm for alternative investment vehicles: hedge fund, private equity, and venture capital firms. He worked there from 2010 until 2015 and during this time Rothstein was acquired by KPMG. James became an expert in real estate tax matters while offering tax and wealth management counsel to partnerships, trusts, REITs, corporations, and high-net-worth clients. He serviced private equity real estate firms with collective assets under management over $10B and consulted on over $2B of real estate transactions.

During this time from 2010 – 2015, James earned his California CPA license and was admitted to the Dollinger Master of Real Estate Development program at USC’s Sol Price School of Public Policy. He earned his Master’s in Real Estate Development (MRED) in 2015, graduating in the top 5% of his class and achieving an honorable mention for outstanding performance on the final comprehensive examination, all while continuing to work part-time for KPMG. He focused his undergraduate studies in Real Estate Finance and International Business, earning bachelor’s degrees in both Accounting and Business Administration from USC. His undergraduate academic achievements at USC included being accepted into the Marshall School of Business Honors Program and earning a spot on the Dean’s List. His collegiate social life centered around the Delta Chi Fraternity where he was elected to become a member of the executive committee. His summers were spent learning the nuances of real estate while serving internships in a variety of settings: residential mortgage lending, home building, and both corporate and onsite property management.

Mr. Bohan stays active professionally with involvement in the NIBCA, Information Management Network, and various other trade organizations. An avid traveler, he has visited over 40 countries, spent a semester studying abroad at Thammasat University in Thailand, and possesses dual citizenship in the United States of America and the Republic of Ireland.

⚡ Site Built with BAMF Technology ⚡